All our lives, we are told to work extremely hard, so that we can enjoy our retirement and forget the troubles we may have suffered serving our employers. However, we focus so much on saving up for retirement that we sometimes forget to actually plan for the post-retirement phase. For many in the United States, the dream of retirement may not be a dream after all as millions of retirees are living longer than expected and uncertain financial conditions erode spending power, causing retirees to reduce expected spending habits. It is longevity risk that plagues these individuals from truly enjoying the lifestyle that they want to live, but there is a way to combat this. In this article, I want to talk about why people fail to prepare for retirement successfully, the benefits of longevity insurance, and the psychological barriers behind why people do not buy it.

Why People Outlive their Savings

After reading through many studies and surveys, it is evident that many retirees and investors are not properly planning for retirement or fear about the dwindling returns of their retirement income. In a study conducted by Stone Ridge, it is stated that 90% of retirees are limiting spending to protect against future market and life uncertainties and that 61% will outlive their savings. In addition, more than a third of investors are under-predicting their potential age of death, with young investors between the ages of 55-59 to underpredict life expectancy 5 years below the average respondent. Finally, 2 in 3 Americans fear running out of money more than death, with this pessimistic outlook maybe coming from the high inflation we are currently experiencing and lack of financial knowledge on how to plan for retirement. As these statistics show, retirement may not be as relaxing to many as it should be.

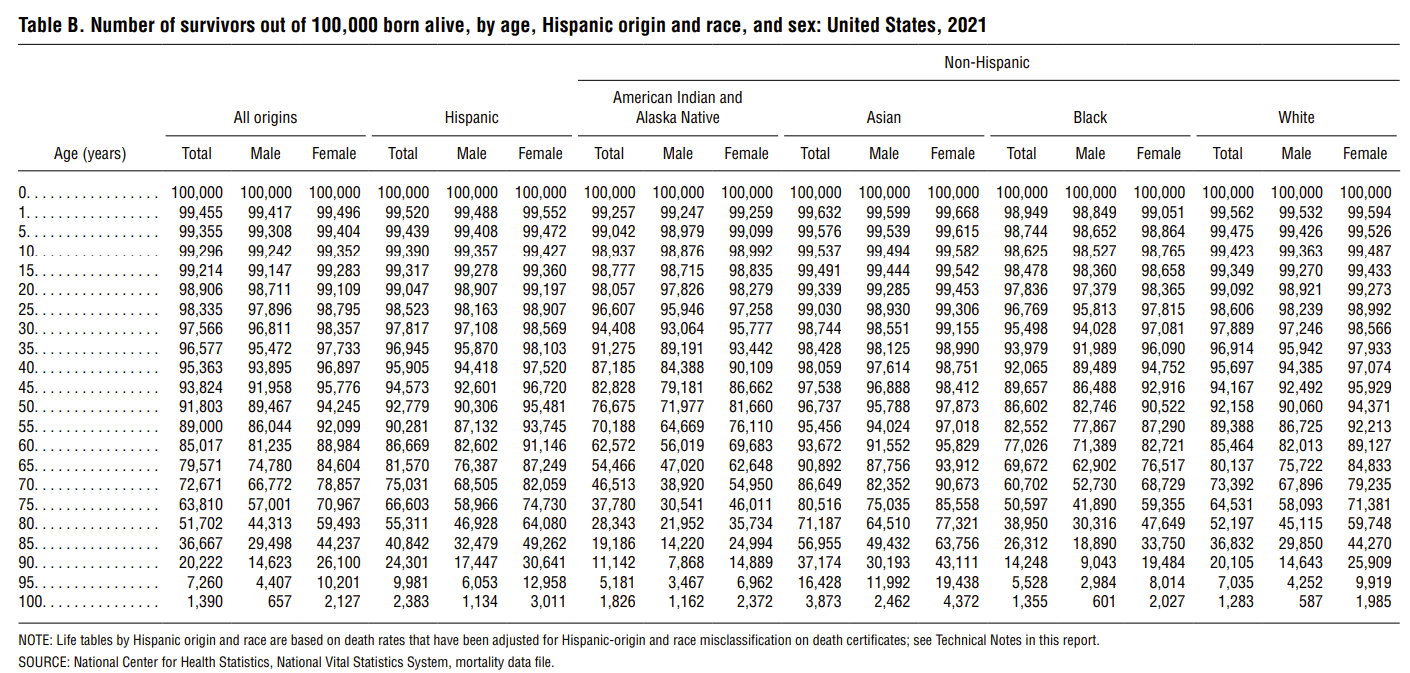

For why so many retirees have anxiety about their post-retirement life, it is important to understand trends that have had profound impacts on longevity risk. The first one is that people are living a lot longer than in the past, largely due to advancements in healthcare technology and medicine. For recent developments that are improving life expectancy, gene editing like CRISPR therapy has been approved to help with sickle cell disease and the drug Leqembi got FDA approval that helps slow Alzheimer’s disease, which affects 6.7 million Americans age 65 and older. These are a few of the many works of those working in life sciences that have allowed people to live longer, presenting a challenge to those planning for retirement. In the United States, the average life expectancy for males and females was 73.5 and 79.3 in 2021, far higher than what it was even just 10 years ago. Below depicts a 2021 table from the United States Life Tables.

It can be observed that for every 100,000 people, there is a 29.50% and 44.24% chance a male and female live to 85; for those male and females, there is a 14.62% chance and 26.10% chance. Given that the average person retires at 63 in the United States, there are serious financial implications that concern individuals who may live past what they may have originally planned or did not plan for. Especially for wealthier individuals that can obtain access to private health insurance and pay for the high costs of certain drugs, they tend to live past the average life expectancy.

The second trend is the uncertainty surrounding public markets and capital preservation utilizing conventional strategies like the 60/40 allocation to equities and fixed income. For a long time, a relatively stable, low interest rate environment has supported strong stock and bond performance, which make up a large percentage of many retirees’ portfolios. Now, higher interest rates have not only decreased the value of bonds but caused a huge rise in inflation, which has decreased consumer spending power. Risk-parity strategies that may be deployed have struggled over the past few years, especially as the correlation between stocks and bonds has been the highest since 1998. For equities, which have seen significant returns for investors over the past few decades, there are questions of whether these returns can be replicated again amidst a more volatile stock market, according to DataTrek. All of this has caused some to allocate more capital into private markets in the forms of private credit and multi-strategy hedge funds recently, but these can only be accessed by retirees with high net worths that can make the initial investment. While it is true that these market conditions are transitory and may return to being more calm, such spikes in volatility and concerns about investment returns from stocks and bonds put pressure on retirees’ non-guaranteed income.

Finally, guaranteed income streams that retirees may rely on can not be relied on as heavily to supplement one’s retirement income as in the past, with some examples being a pension or Social Security. Up until the 1980s, defined-benefit plans like pensions were extremely popular within the private sector, but there has been a shift to defined-contribution plans like Roth or Traditional IRAs for a few reasons. For employers, accurately projecting pension liabilities is very difficult so rather than taking on the longevity and investment risk, they transfer those to the employee to figure out. Furthermore, it is easier to manage defined-benefit plans as the costs are more predictable and employers know how much to set aside without accumulating losses from people retiring early or dying late. There are still corporations that offer pensions, but there is no guarantee the money will be paid out if corporations decide to cut the pension -- look at General Motors in the past as an example. For the Social Security Trust Fund, while it may never fully run out of money, there are predictions that the fund will start reducing total benefits in as early as 2034. This will cause many retirees to rethink how to supplement this shortfall in Social Security with additional streams of retirement income, with about 40% of retirees solely relying on Social Security. This does not even take into account if politicians make cuts to Social Security or other government-backed programs like Medicare, which would increase expenses that may not have been planned for by retirees. As Larry Fink said in his most recent Investors Letter, these factors have caused people to realize “a shift from financial certainty to financial uncertainty,” evidence that no income stream is guaranteed.

Benefits of Longevity Insurance

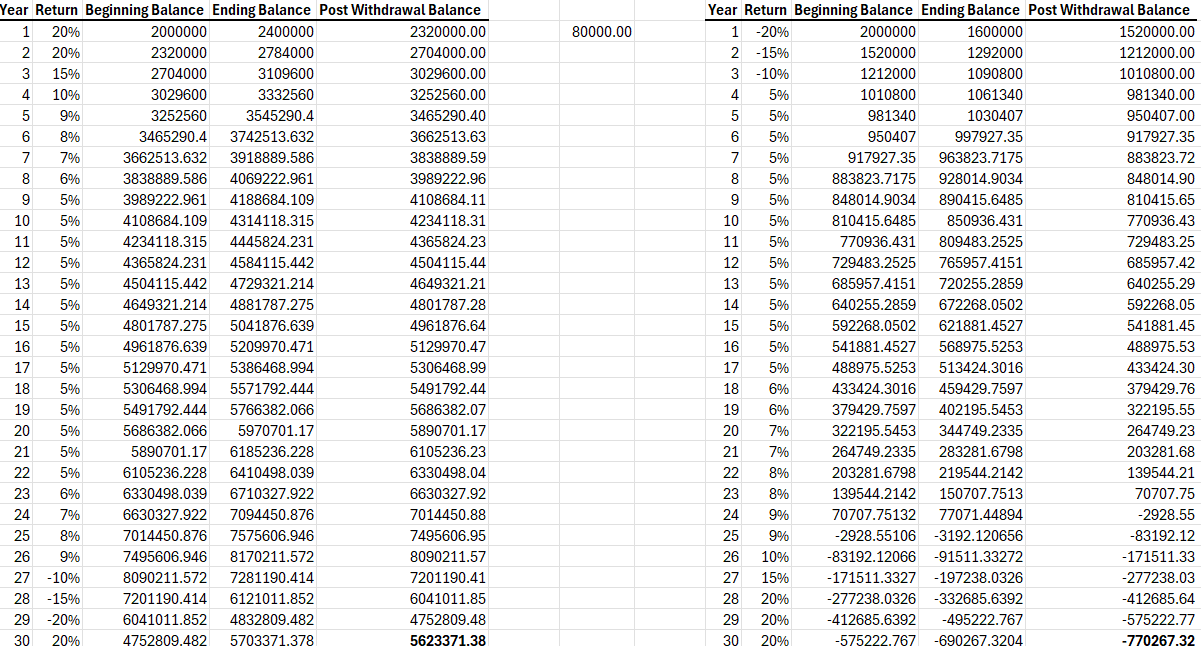

There are a wide range of answers when asked how much one will need to retire comfortably. Some may say $1 million, others will say $2 million, and some may even say $5 million. Whatever that number is, there is a 4% rule that states for a 30-year retirement period, a 4% withdrawal from a portfolio for the first year followed by withdrawal rates adjusted for inflation should keep one’s portfolio safe from being depleted. But how well does this rule apply to today? For one, it makes the assumption that people actually follow the 4% rule strictly and do not withdraw beyond that. In addition, it makes the assumption that there are no significant life events that deplete one’s portfolio. Whether that is helping one’s kids who have lost their jobs, covering sudden cancer treatment expenses, or divorce, these things will cause one to either cut spending or take on more investment risk by placing more weight in a portfolio on assets like stocks, which are known to be more volatile than treasuries or money market funds. Especially if these events happen early on in one’s retirement, it can have devastating effects on the 4% rule if followed. For example, pretend we have a $2 million dollar portfolio along a 30-year time horizon and returns on average 5% annually, in line with what experts say a balanced retirement portfolio of stocks and bonds should be. The first table will show strong, positive returns in the start and then negative returns at the end, while the second table will show negative returns in the start and then strong, positive returns at the end. Below are the two tables.

In the first scenario, the portfolio value increased, whereas the portfolio value turned negative in the second scenario. While there are many unrealistic assumptions being made here and factors that I am not accounting for, I wanted to show that following the 4% rule is not a useful guideline when looking at negative shocks to one’s portfolio. Tackling investment risk and longevity risk at the same time makes retirement planning one of the toughest things to do. Therefore, what can retirees do to have more peace of mind over their retirement life?

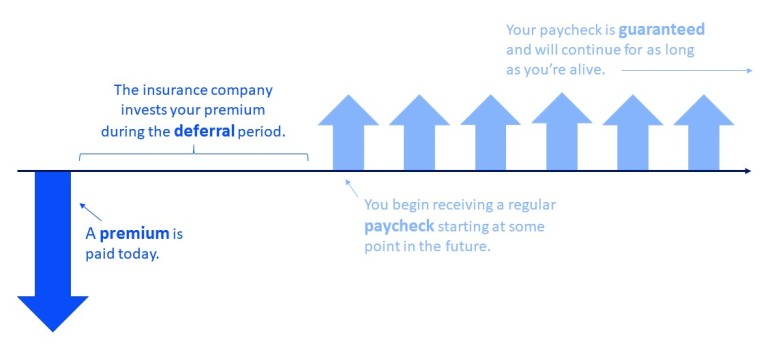

Longevity insurance may be the key to this problem. It is a deferred annuity that a retiree buys from an insurance company, which guarantees income for life at a predetermined date of usually around 80-85. The retiree only needs to make a one-time payment and the amount of income will depend on how long the annuity is deferred for; the longer the deferral, the more annual income a retiree will receive. In addition, if one dies before the deferral period, the payments are not received. For longevity insurance policies, the insurer will take the money from policyholders and put it into assets like IG corporate bonds, making sure that it makes a consistent return to have enough to pay for the longevity annuities if policyholders are still alive and any potential losses due to longevity risk for itself. For insurers, they make sure they price the premiums and payouts to a point where they can still gain profit because they still need to make money from this. For retirees, those who live a long enough life will not only have the guaranteed protection of a recurring income but also an income that returns more than what one would receive from one’s investment portfolio. Below is a simple graph of what it is.

The whole purpose of longevity insurance is that it helps cover expenses that were not planned for due to living longer, something that can be difficult to predict. When we are young, we buy life insurance as we tend to value the future income we will make in years to come. When we get older, as our expected future income decreases, so does the value of buying life insurance and subsequently increases the value of buying longevity insurance. For those who best fit the need for longevity insurance, it is important to understand one’s risk tolerance and financial situation. If someone is risk-averse, longevity insurance makes sense as the whole purpose of the policy is to create income protection for the individual in the case that one lives longer than expected. In terms of financial situation, it should be recommended to retirees who lie in between those with a lot of assets to cover expected and unexpected retirement expenses and those with not enough assets. If one has enough assets, there is no need for income protection as the individual can withstand any market volatility and take on longevity risk. If one does not have enough assets, then capital accumulation should be the main focus. Therefore, it requires a thorough assessment of one’s finances before purchasing the policy.

Psychological Barriers Behind Purchasing Longevity Insurance

As noted, it makes sense to buy longevity insurance for a multitude of reasons. It gives individuals financial freedom, reduces stress over running out of money, and reduces any financial burden individuals close to you may feel as you grow old. However, longevity insurance is not a popular product that people are buying. According to Limra, out of the $385.4 billion in annuity sales in 2023, only about $4.2 billion of that was in deferred income annuities (DIAs) -- from my knowledge, longevity insurance is a type of DIA, which means longevity insurance sales were even smaller than the DIA sales amount. While the sales of these DIAs nearly doubled from 2022-2023, they make up only a little more than 1% of the sales. There are some possible explanations for why they are not as popular as they should be.

One reason can be explained through the concept of hyperbolic discounting or the tendency to value small rewards in the short-term over large rewards in the long-term. The longevity insurance policy premium can be a six-figure amount and some retirees do not want to forgo that much money that they do not know will yield a benefit in the future. They would rather use that money to travel the world, use it as a downpayment for a vacation home, or set up a college fund for their grandchildren. So the potential loss due to dying early has far greater weight than the gain in future benefit from the longevity insurance, creating a sense of loss aversion for many. Another reason is that some may be worried about one’s insurance company becoming insolvent, meaning that payments technically are not guaranteed at a certain start date. While one should entrust their insurance policy with a large insurer with a strong balance sheet like a New York Life or MetLife, that does not mean that a bankruptcy is an impossibility. Therefore, for someone thinking about buying longevity insurance that will payout a few decades into the future, there is counterparty risk that a person may not want to take on from a potential insurer’s bankruptcy. Finally, there are concerns about inflation eroding the value of any annuity payments that may come. During the deferral period, individuals bear the inflation risk and while people can pay a premium for inflation-adjusted annual payments, it still does not fully protect against inflation. In all, these are some highlights for why people are wary of making the purchase of longevity insurance.

As stated by wealth management professor Michael Finke, the longevity annuity is “probably the most difficult financial product to sell.” But given the benefits they provide, I believe that they should be purchased more often than they actually are and marketed better to people. The best way to do this is through financial advisors; however, according to a survey, the majority of financial advisors do not recommend annuity products and even when they do, most clients do not listen to their recommendations. For the latter part, individuals may not know how to value annuities and think about longevity risk; therefore, a lack of financial literacy causes individuals to not buy these annuities. But in addition, some financial advisors are compensated on AUM, meaning that selling annuities as a financial advisor does not directly tie easily to compensation. Selling longevity insurance would require a client to sell assets to purchase the policy, reducing the AUM of the financial advisor, which would not be in their best interest. Also, it is noted in a paper how advisors will advise clients to roll over their 401k plans to IRAs instead of annuitize them because of the recurring advisory fees they would receive as opposed to a one-time fee. Therefore, an advisor’s compensation structure creates a mismatch of incentives between financial advisors and their clients, which should not be the case as the financial advisors should solely act in the client’s best interest as a fiduciary. While development within the wealth management industry may change to encourage better marketing for longevity insurance to clients, there are still some headwinds that are currently being faced.

I believe longevity insurance is truly the best way for people to live their best retirement life and the concept of longevity risk needs to be talked about more online. There is so much more that can be covered, but hope you enjoyed this article!

Word Cited

Arapakis, Karolos, and Gal Wettstein. “Do Financial Professionals Recommend Annuities?” Center for Retirement Research, 19 Dec. 2023, crr.bc.edu/do-financial-professionals-recommend-annuities/.

Clancy, Luke. “Can Risk Parity Ride out the Storm of Correlated Asset Chaos?” Risk.Net, 5 Feb. 2024, www.risk.net/investing/7958954/can-risk-parity-ride-out-the-storm-of-correlated-asset-chaos.

Dave Strausfeld, J.D. “Longevity Annuities: Why Clients Should Consider Them.” Journal of Accountancy, Journal of Accountancy, 30 May 2023, www.journalofaccountancy.com/news/2023/may/longevity-annuities-why-clients-should-consider-them.html.

“Limra: Record-High 2023 Annuity Sales Driven by Extraordinary Growth in Independent Distribution.” LIMRA.Com, 12 Mar. 2024, www.limra.com/en/newsroom/news-releases/2024/limra-record-high-2023-annuity-sales-driven-by-extraordinary-growth-in-independent-distribution/.

“NVSS - Life Expectancy.” Centers for Disease Control and Prevention, Centers for Disease Control and Prevention, 29 Nov. 2023, www.cdc.gov/nchs/nvss/life-expectancy.htm.

“Redefining the Retirement Experience.” Stone Ridge, 2023, www.stoneridgeam.com/docs/SR-Survey-Q2-2023.pdf.

Soni, Aruni. “The Stock Market Is Riskier and More Volatile than It Was in Past Decades. Here’s Why.” Business Insider, Business Insider, 26 Oct. 2023, markets.businessinsider.com/news/stocks/stock-market-risk-volatility-big-tech-large-cap-magnificant-seven-2023-10.

Thetrinapaul. “Will Social Security Run out of Money? Here’s What Could Happen to Your Benefits If Congress Doesn’t Act.” CNBC, CNBC, 30 July 2023, www.cnbc.com/select/will-social-security-run-out-heres-what-you-need-to-know/.

Tretina, Kat. “The Average Age of Retirement in the U.S.” Forbes, Forbes Magazine, 26 Jan. 2024, www.forbes.com/advisor/retirement/average-retirement-age/.

“Understanding Private Sector Longevity ...” Retirement Income Institute, Dec. 2021, www.protectedincome.org/wp-content/uploads/2022/02/LR-05-Turner-FN-AH-_12.14.21.pdf.

“A Visual Depiction of the Shift from Defined Benefit (DB) To ...” Congressional Research Service, 27 Dec. 2021, crsreports.congress.gov/product/pdf/IF/IF12007.